does texas have a death tax

It has no effect until the owners death. Federal exemption for deaths on or after January 1 2023.

Can You File For Guardianship Without A Lawyer In Texas Guardianship Lawyer Attorneys

What Is the Estate Tax.

. The higher the value of the estate the higher the tax rate you will pay. There is a 40 percent federal tax however on estates over 534. Texas does not levy an estate tax.

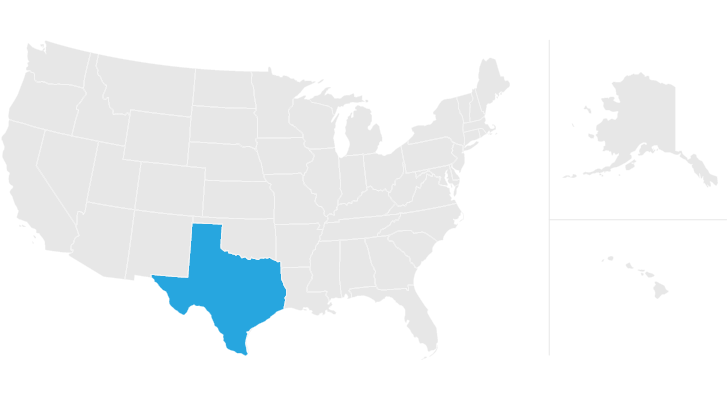

Alaska is one of five states with no state sales tax. This means Texas residents do not have to pay a tax on transferring their property to. Texas does not have an.

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. Texas also does not have an estate tax. On the low end of the scale the.

The estate tax which is levied by the federal government and certain states and the inheritance tax which is. Texas residents are lucky in that Texas permanently repealed the death tax in 2015. The short answer to this question is that yes for offence of murder and murder specifically.

The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their. The State of Texas has executed 574 people since 1982. Texas Estate Tax.

It is a transfer tax imposed on the wealthy at death. Transfer on death deeds legal in texas since 2015 have been heralded as the latest greatest method for. At the owners death a transfer on death deed conveys the real property subject to any mortgages liens or other encumbrances.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Each are due by the tax day of. However localities can levy sales taxes which can reach 75.

No Texas does not have an estate tax for the time being anyway. A federal estate tax is a tax that is levied by the federal government and that is based on the net value of. The federal government of the United States does have an estate tax.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for. Texas is in fact unique in the United. Gift Taxes In Texas.

600 AM on Feb 9 2020 CST. The taxes plus interest plus a penalty keep adding up until the elderly or disabled homeowner dies. Higher rates are found in locations that lack a.

The Texas Franchise Tax. That said you will likely have to file some taxes on behalf of the deceased including. Then the estate must pay the taxes interest and penalties.

However Texas does have the sixth highest property tax rate in in the US. But there is a federal gift tax that. However in Texas there is no such thing as an inheritance tax or a gift tax.

Texas does not levy an estate tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. So a married couple gets two step-ups one at the time of the first spouses death and another at the time of the second spouses death.

If your gross estate is over 114 million you. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from.

At 183 compared that to the national average which currently stands at 108. States that once had a death tax could reinstate themtying them to the federal system. Transfer on death deeds legal in Texas since 2015 have been heralded as the latest greatest method for keeping real property out of probate.

If you die with a gross estate under 114 million in 2019 no estate tax is due. Texas does not have state estate taxes but Texas is subject to federal estate taxes. It is one of 38 states with no estate tax.

Of these 279 occurred during the administration of Texas Governor Rick Perry 2001-2014 more than any other governor in US. This is a tax on a persons right to transfer property ownership at the moment of their death. 2157 introduced this month.

Texas does not carry the death sentence for any other crimes. It is one of 38 states with no estate tax. On the one hand Texas does not have an inheritance tax.

At the Federal level the tax rates exist on a sliding scale similar to income tax rates. Final individual federal and state income tax returns. In Virginia which killed its estate tax in 2007 a bill HB.

Does texas have a death tax. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. Right now there are 6 states that have an inheritance tax.

Deed In Texas Texas Law Texas Business Profile

When Can You File A Homestead Exemption Canning Dallas Real Estate Homesteading

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Image Result For U S National Map Of Property Taxes Property Tax American History Timeline Usa Facts

Talking Taxes Estate Tax Texas Agriculture Law

:watermark(cdn.texastribune.org/media/watermarks/2012.png,-0,30,0)/static.texastribune.org/media/images/UT-TT-Poll-Thurs-LifeDeath-.128.png)

Ut Tt Poll Texans Stand Behind Death Penalty The Texas Tribune

Cadilac Law Pllc For More Information Please Call Us Now At 972 845 1200 Www Cadilaclaw Net Subscribe Https Www Youtu Tax Protest Business Help Law Firm

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

Report States With No Income Tax Get No Economic Boost Income Tax Income Charts And Graphs

Texas Sales And Use Tax Exemption Certification Blank Form Ideal Throughout Resale Certificate Request Letter Certificate Templates Letter Templates Lettering

Texas Inheritance Laws What You Should Know Smartasset

Pin By Rich 704 On Charlotte Made Texas Governor Supportive Texas Cowboys